rates for a basic savings account.

“People who immediately benefit from the high rates are usually those who are able to

maintain high balances and can afford to open another deposit account outside of their

current banks. Beyond the introductory rate, unusually high interest rates are not

permanent, nor sustainable,” explained Carmina Marquez, BPI Deposits Head.

This is the reason the Bank of the Philippine Islands (BPI) is introducing honest-to-

goodness savings products that are not only easy-to-open but also uniquely and

sustainably rewarding—the #SaveUp digital deposit accounts. #SaveUp is now

available not only through the BPI mobile app but also via GCASH app’s GSAVE

feature called BPI #MySaveUp.

These BPI products offer a convenient and trusted option for digital natives and banking

newbies, with low initial deposit, affordable maintaining balance, and more attractive

savings rate than what one gets from typical savings accounts opened via bank

branches.

“What makes this BPI product unique is instead of participating in accounts with high

interest rates that usually benefit the more affluent depositors, it provides an easier,

more fun way of saving through a gamified rewards program that can benefit more

people from all walks of life,” said Marquez.

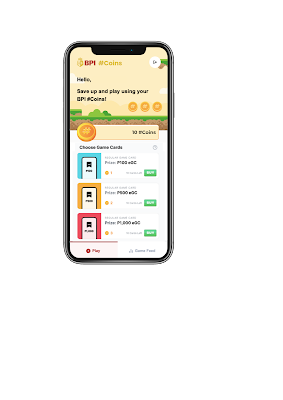

Called #Coins, this program rewards depositors with virtual game coins as they

save. The #Coins can be used to win prizes such as cash vouchers and wallet credits,

an automatic KIA Stonic Style Edition car, or an Avida Vireo Studio condominium unit.

“BPI introduces another first with our #Coins rewards program for #SaveUp

depositors. We want to make saving more affordable, more convenient, more fun and

more rewarding. This is our way of making saving more inclusive and encouraging

those who have not yet tried banking to do so easily. This is also our way of giving our

depositors a chance to own a brand-new SUV or a prime condominium unit as they

grow their savings—things that remain aspirational for so many Filipinos. Through

#SaveUp made rewarding with #Coins, we hope to invite more Filipinos to experience

banking and begin their journey towards achieving their dreams,” said Ginbee Go, BPI

Consumer Banking Head.

The #CoinsProgram rewards clients with one coin per month if their BPI #SaveUp or

#MySaveUp account has at least P3,000 worth of transactions each month that include

branch and digital deposits, remittance, funds transfers, and similar services. Depositors

may also earn extra coin for every P10,000 saved in their BPI #SaveUp or #MySaveUp

account by end of the month.

Game perks

Through the #COINS Program, BPI rewards its depositors with virtual game coins every

time they save, which they can use to win prizes such as electronic gift certificates.

Every month, there are 5,000 eGCs worth P100 available for clients, 500 winners of

P500 eGC, and 100 winners of P1,000 eGC; add to that two major prizes: an automatic

KIA Stonic Style Edition car and an Avida Vireo Studio condominium unit in Arca South.

Depositors will be able to enjoy these game perks in the #Coins microsite, which

features a Winners Gallery that display the users who already won a prize. It also shows

how many total #Coins are at play, and how many available eGC prizes there are to

help users strategize and control their game luck.

The Bangko Sentral ng Pilipinas (BSP) recently reported that “savings deposits had the

biggest share of total deposits at 48.7 percent.” This is as the Philippine banking system

(PBS) sustained its solid footing amid the pandemic, according to the “Recent Trends in

the Philippine Financial System” report released by BSP in January 2022.

“Especially during this time of high inflation, it is important to sustain the growth

momentum of the deposit and savings segments. BPI will continue to do its part and

launch new innovative products and programs with convenient digital options, as well as

easy access, and a more rewarding experience. A more financially inclusive economy is

how we, in BPI, can help build a better Philippines,” said Go.

To earn #Coins while saving, interested depositors may open a #SaveUp by

downloading the BPI mobile app, or open a #MySaveUp account from the GSAVE

menu of the GCASH app.

ABOUT BPI

The 171-year-old Bank of the Philippine Islands is the first bank in the Philippines and Southeast Asia. We are licensed as a

universal bank by the Bangko Sentral ng Pilipinas to provide a diverse range of financial services: deposit taking and cash

management, payments, lending and leasing, asset management, bancassurance, investment banking, securities brokerage, and

foreign exchange and capital markets. BPI has significant financial strength, with robust Tier 1 capital adequacy ratios and

profitability, underpinned by stringent compliance and risk management regimes. E-mail: Media: mjsilvestre@bpi.com.ph Investors:

Investorrelations@bpi.com.ph. Bank of the Philippine Islands l Ayala North Exchange Tower 1, Ayala Avenue corner Salcedo St.,

Legaspi Village, Makati City 1229 PH l +632 8246 6364l www.bpi.com.ph

No comments:

Post a Comment